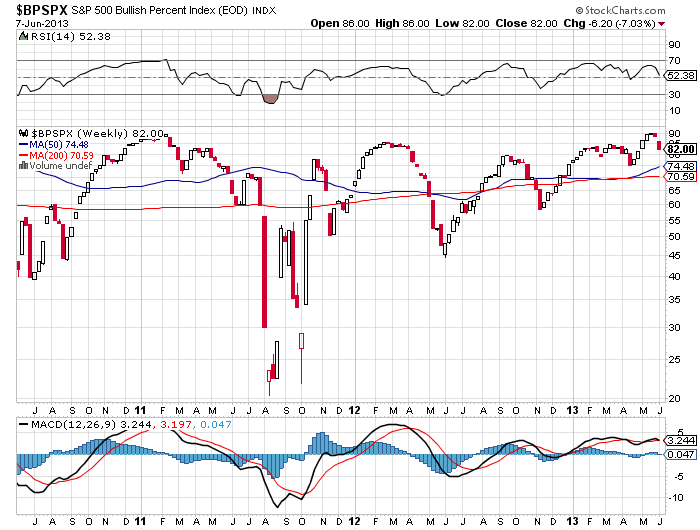

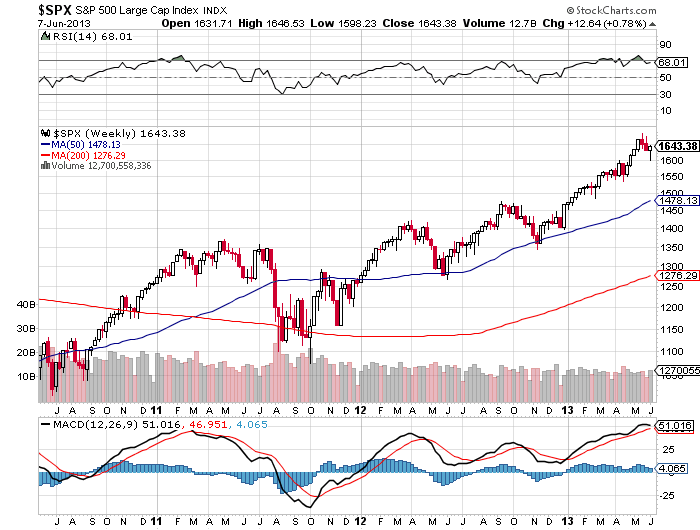

Compare the charts of the Bullish percent index of the S&P 500 and the S&P 500 Index which are respectively listed.

I'll provide some thoughts down below.

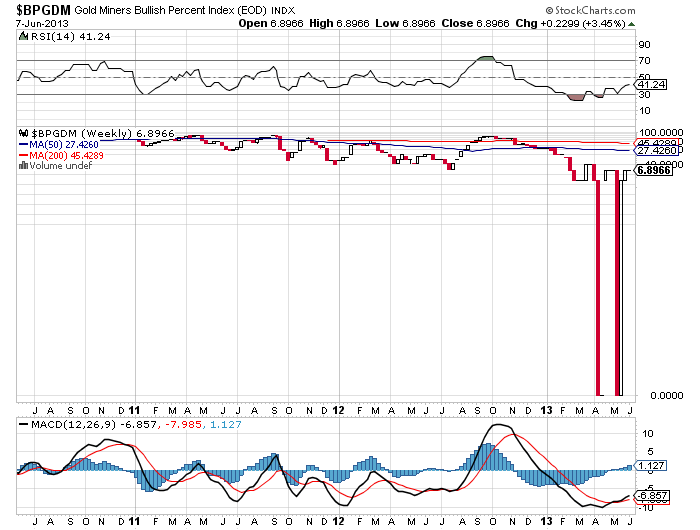

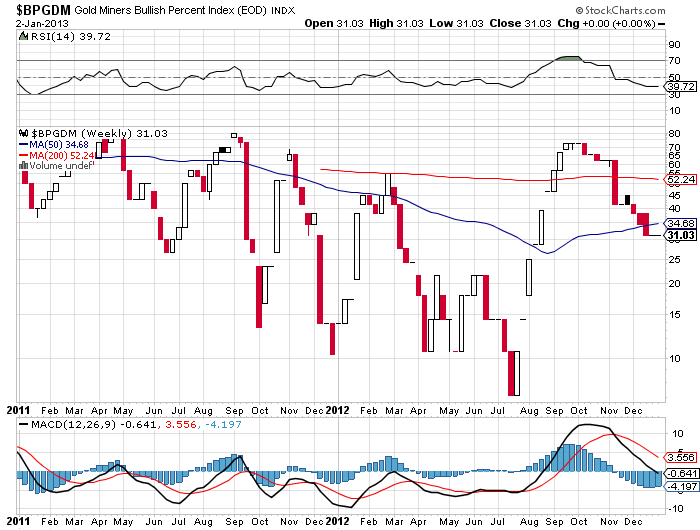

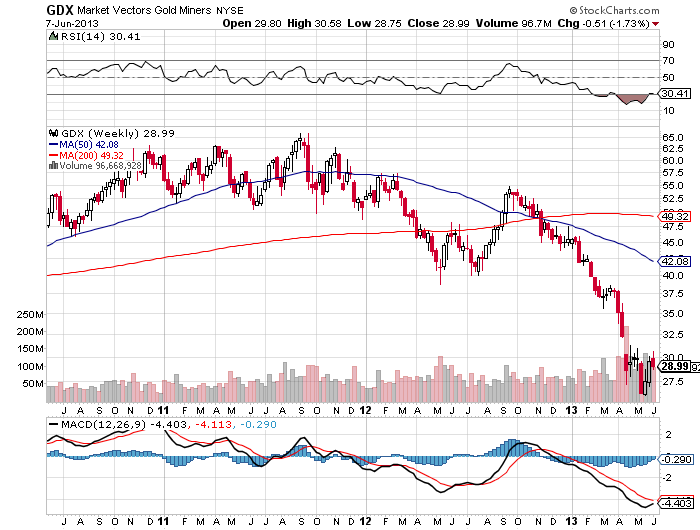

Now, please examine some charts of the Gold Miners, which has been a market full of bearish sentiment lately. The second chart provides a cleaner view of the full year bullish percent for 2011 and 2012.

Heck, the weekly MACD indicator is also almost crossing over and relative strength is now just over 30. This shows that Gold Miners definitely have some room to run on the upside.

This shows me that the lows being made in gold now are much like the lows made in the broader stock market in late 2008 and early 2009. When the stock market hit those major lows, the bullish percent indicator was 10 and 17 respectively in those months.

RSS Feed

RSS Feed